Featured

By expanding broadband access and investing in America’s future, we can open a bridge to possibility for all.

Search

Filter

Location

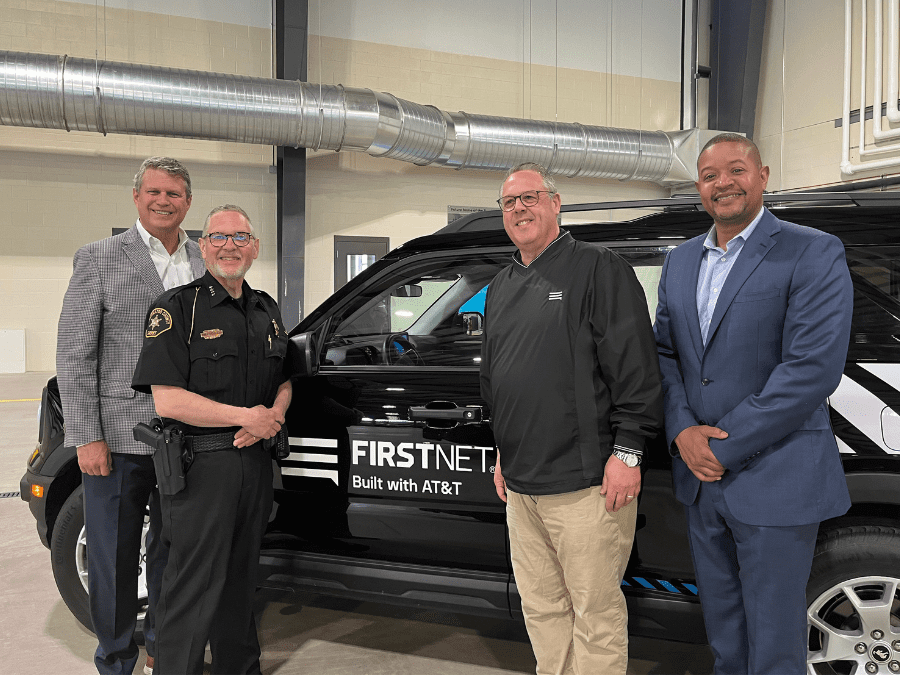

Kalamazoo County Sheriff’s Office, Road Commission Transform First Responder Communications with FirstNet

- Public Safety

- |

Continuing Efforts to Bridge the Digital Divide with the Buffalo Urban League

- Broadband Access and Affordability, Community Impact

- |

Celebrating One Year of Mason the Comfort Dog

- Public Safety

- |

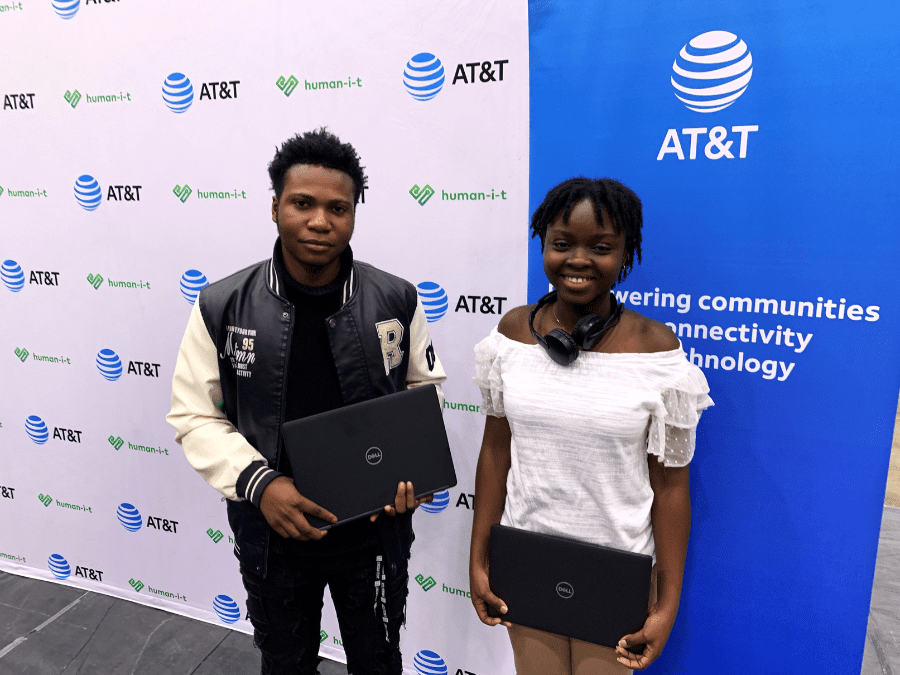

Helping Indianapolis Students Connect in A ‘Very Digital World’

- Broadband Access and Affordability, Community Impact

- |

‘Making Life Accessible to People’: Grand Rapids’ Sonja Forte is Helping Bridge The Digital Divide

- Broadband Access and Affordability, Community Impact

- |

This Chicago Professor Emphasizes the Power of Connectivity

- Community Impact

- |