Featured

By expanding broadband access and investing in America’s future, we can open a bridge to possibility for all.

Search

Filter

Location

Connecting Rincon College Students to a Brighter Future

- Broadband Access and Affordability

- |

AT&T Celebrates International Girls in ICT Day 2024 in Slovakia

- International External & Regulatory Affairs

- |

Helping Customers Adjust to the End of ACP

- Broadband Access and Affordability

- |

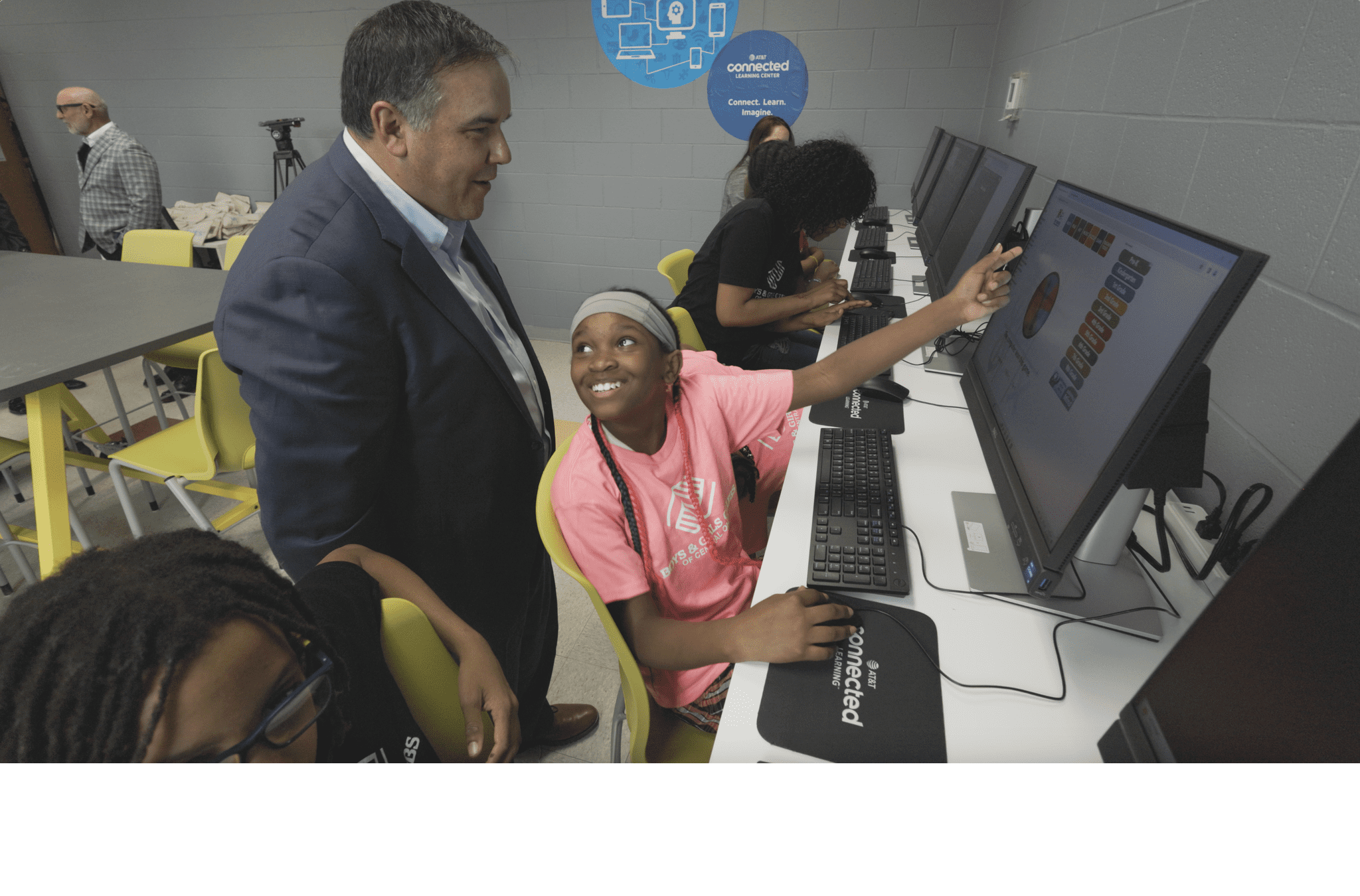

Celebrating Central Ohio’s First AT&T Connected Learning Center

- Broadband Access and Affordability, Community Impact

- |

Outcomes Not Optics: Our Commitment to the Digital Divide

- Broadband Access and Affordability

- |

Connecting Rural California to Fiber Internet for a Better Future

- Broadband Access and Affordability

- |