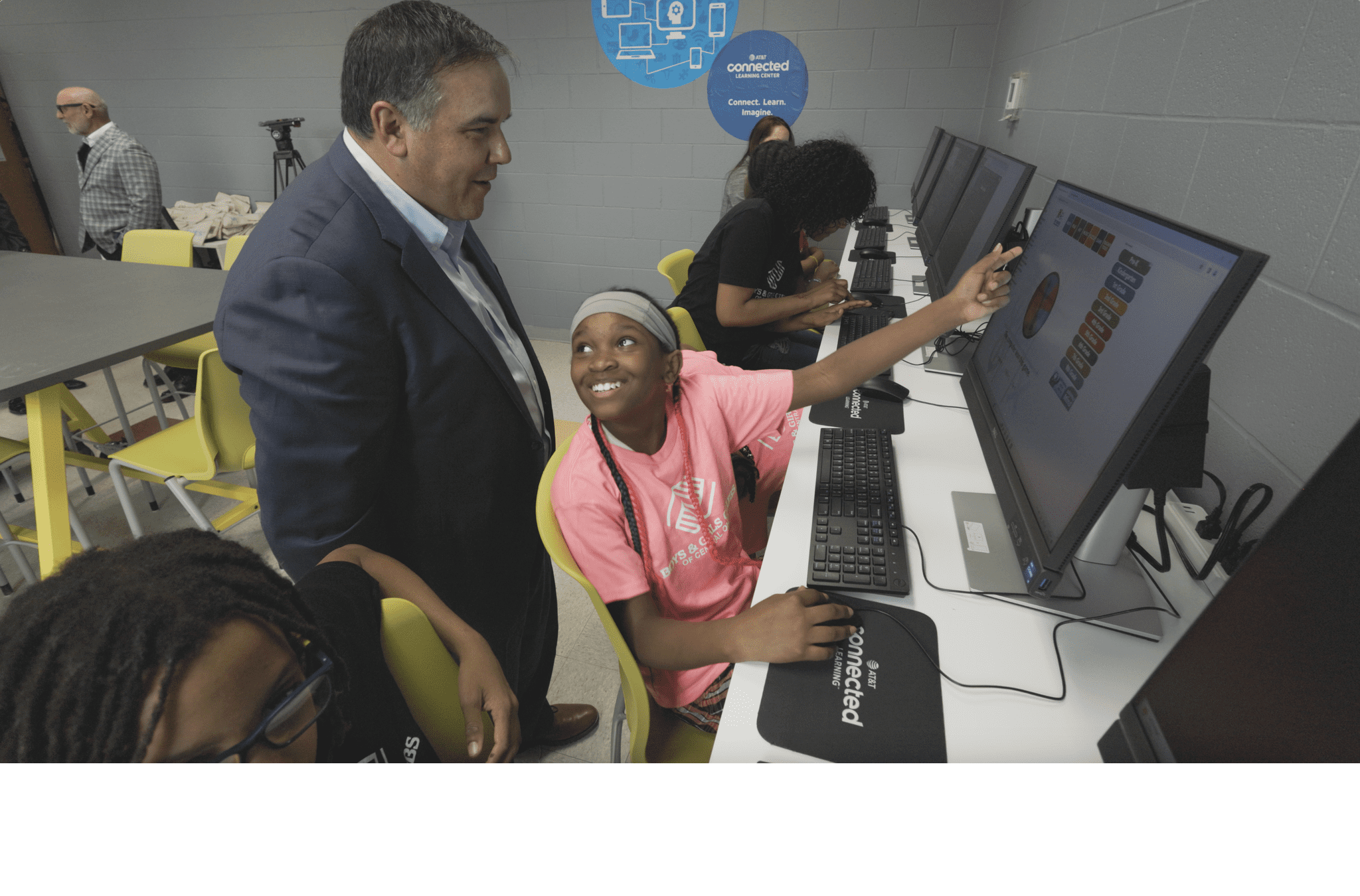

AT&T Celebrates International Girls in ICT Day 2024 in Slovakia

- International External & Regulatory Affairs

- |

We connect people to greater possibilities. AT&T Connects spotlights stories, news, events and local updates that can help inform decisionmakers and public policy to ensure we can connect to a brighter future together.

Working to connect more households and bridge the digital divide.

Fostering stronger, more involved, and more sustainable communities through the power of connection.

Addressing cybersecurity, data protection, and privacy to ensure that your connections are safe and secure.

Connecting First Responders during critical, lifesaving missions.

Building new technologies that connect people and help solve the problems of tomorrow, today.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |